Although there are no tax deductions offered for living in a “green home” (of course there should be), our residents can rest easy knowing that they’re living in one of the most energy-efficient homes in Southern Delaware. Tax season is coming to a close! As the 15th of April approaches, we’re giving our homeowners a few tips to keep in mind as many rush to meet this year's tax filing deadline!

If You’re Not Prepared, Ask For An Extension

There’s no need to rush to find receipts or other documents needed to file your 2018 taxes. The IRS will offer you a six-month automatic extension to file your 1040 forms if you’re up against the April 15th deadline. According to the IRS’s web page on Extension of Time To File Your Tax Return, there are three ways to request an automatic extension of time to file a U.S. individual income tax return.

- You can pay all or part of your estimated income tax due and indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System, or using a credit or debit card.

- You can file Form 4868 electronically by accessing the IRS e-file using your home computer or by using a tax professional who uses e-file.

- You can file a paper Form 4868 and enclose payment of your estimate of tax due.

To file an extension for your 2018 Delaware state returns, head to the 2018 Form 1027I webpage on the official state government website. Please keep in mind that if you owed for your federal or state tax returns, your payment is still due on the 15th.

E-File With Ease

The IRS offers a wide selection of resources that are guaranteed to make filing your federal tax return simple. Perfect for retirees making less than $66,000 a year, Free File allows homeowners to file their federal individual income tax return for free using tax-preparation-and-filing software. Visit the Free File webpage on the IRS website and take advantage of one of the free software options offered through Free File at IRS.gov. Be sure to review each company's offer to make sure you qualify for your free federal return!

Contribute to Your IRA

Although tax breaks for the 2018 year are no longer available, contributions to your traditional IRA, made by April 15th, can be claimed on your 2018 tax forms. The latest tax laws allow you to set aside up to $5,500 for those who aren't yet 50, or $6,500 for those 50 and older. If you meet the income requirements, Insight residents could deduct the amount they contribute from their gross income.

We know better than most that tax season can get a little complicated, which is why many wait until the deadline to tackle their federal and state returns. You’ve got until the 15th to get your game plan on track! Give these tips a try to take the stress out of filing you 2018 tax returns.

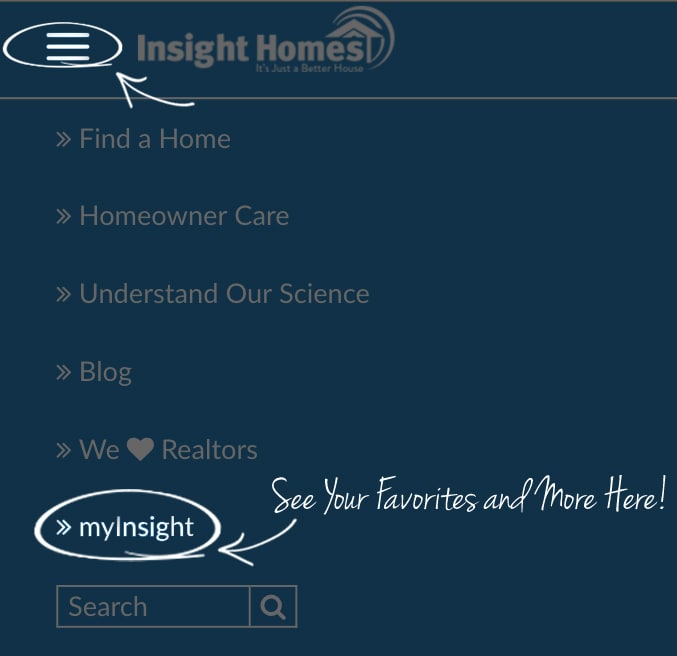

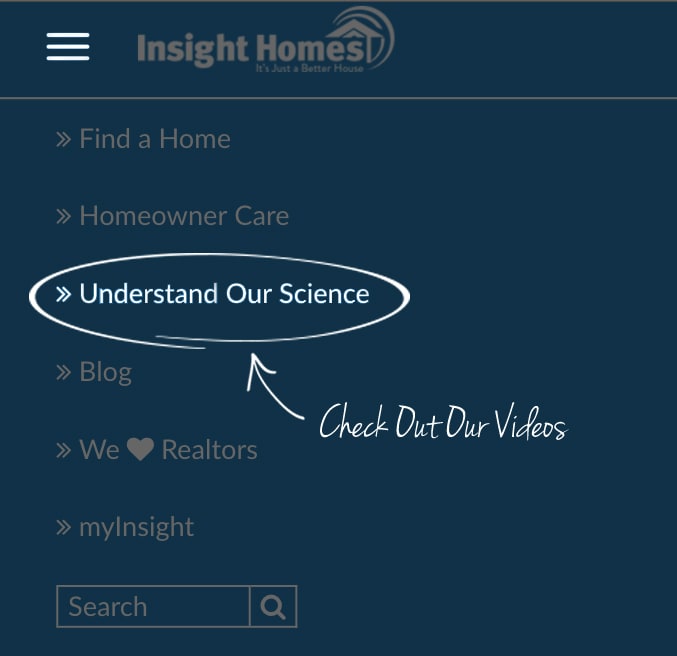

Swipe to learn more

Swipe to learn more