There are some pretty cool perks that come with living in the first state. Sure, there’s the versatile landscapes, beautiful beaches, and Delaware is the “first state” after all! But there’s another reason why many have taken up residence on the shores of Delaware: taxes, taxes, and more taxes (or lack thereof)! For large corporations, Delaware is considered a “tax haven,” due to its state tax laws on intangible assets. But how do these laws affect the residents of Delaware?

%20(1).png)

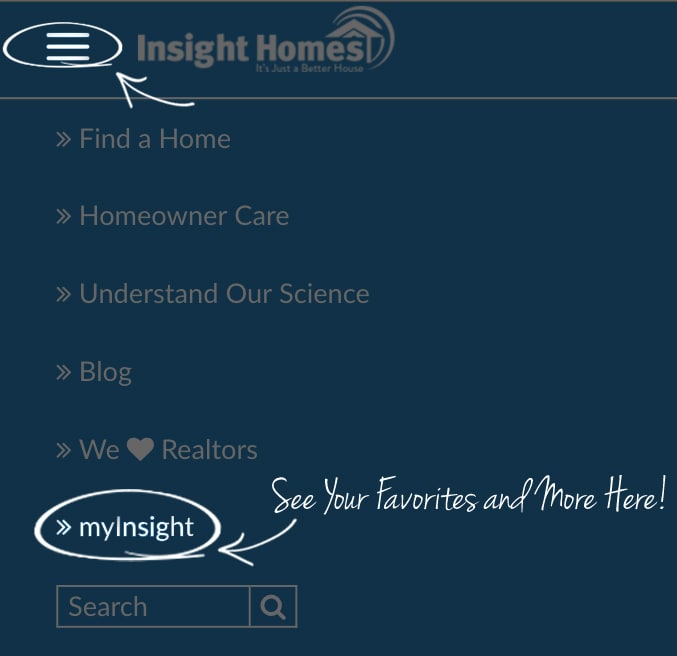

Personal and Real Property Taxes

The state of Delaware does not assess taxes on real or personal property. Your Insight Home is only subject to county property taxes, school district property taxes, vocational school district taxes and if located within an incorporated area, municipal property taxes. The county taxes differ for each geographical area, so contact the property tax office for your county with specific questions.

- New Castle County Department of Finance: (302) 323-2600

- Kent County Department of Finance: (302) 744-2386

- Sussex County Property Tax Division: (302) 855-7871

Sales Tax

Delaware does not assess a sales tax on consumers. Imagine preparing to pay for your new summer clothes from the Tanger Outlets, and realizing there’s no sales tax!

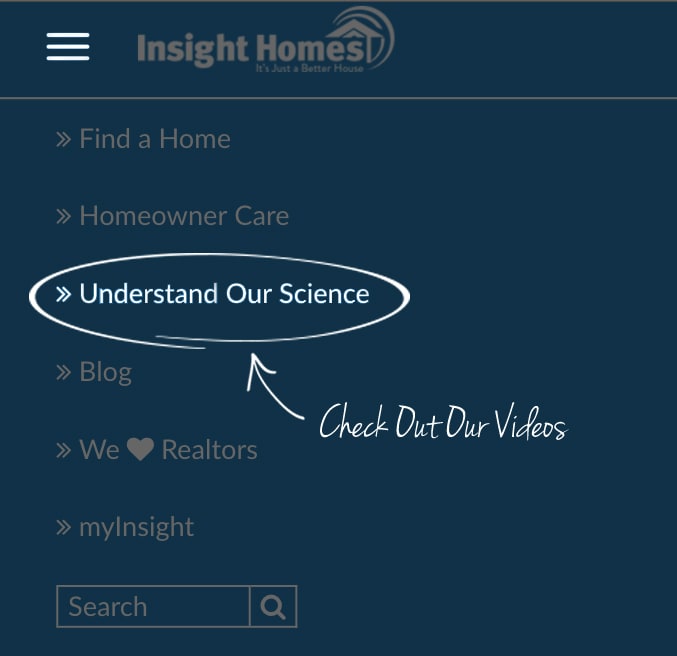

Filing Your Delaware Taxes

The personal income tax deadline for Delaware residents is April 30. Take advantage of electronic filing located on the Department of Finances website, which will make filing your taxes both accurate and easy.

%20(1).png)

Visit Delaware's Division of Revenues website for more information.

Swipe to learn more

Swipe to learn more